Are Our Kids Unprepared to Tackle the Financial World?

Hey there, parents and guardians! Let’s chat about something crucial: our kids and finance. We teach our kids so many things – how to tie their shoes, how to ride a bike, even how to make a mean peanut butter and jelly sandwich. But are we teaching them enough about money? Sure, they learn math in school, but understanding finance goes beyond knowing how to add and subtract.

Think about it: Do your kids know how to budget their allowance? Do they understand the concept of saving for something big instead of splurging on every little thing? Teaching our kids about finance is like giving them a roadmap for life. They’ll learn how to navigate through the twists and turns of money management and come out on top.

Start simple. Talk to them about why saving is important, how to set financial goals, and the difference between needs and wants. Trust me, these lessons will stick with them longer than their fascination with the latest video game.

One fun way to teach kids about finance is through interactive activities. For example, set up a small “store” at home where they can use play money to buy and sell items. This hands-on approach makes learning about money fun and engaging. Also, encourage them to save a portion of their allowance. You could even match their savings to show how interest works.

Another great idea is to involve them in family financial discussions. Let them see how you budget for groceries, utilities, and other expenses. It might seem boring to them now, but these real-life examples will be invaluable when they start managing their own finances.

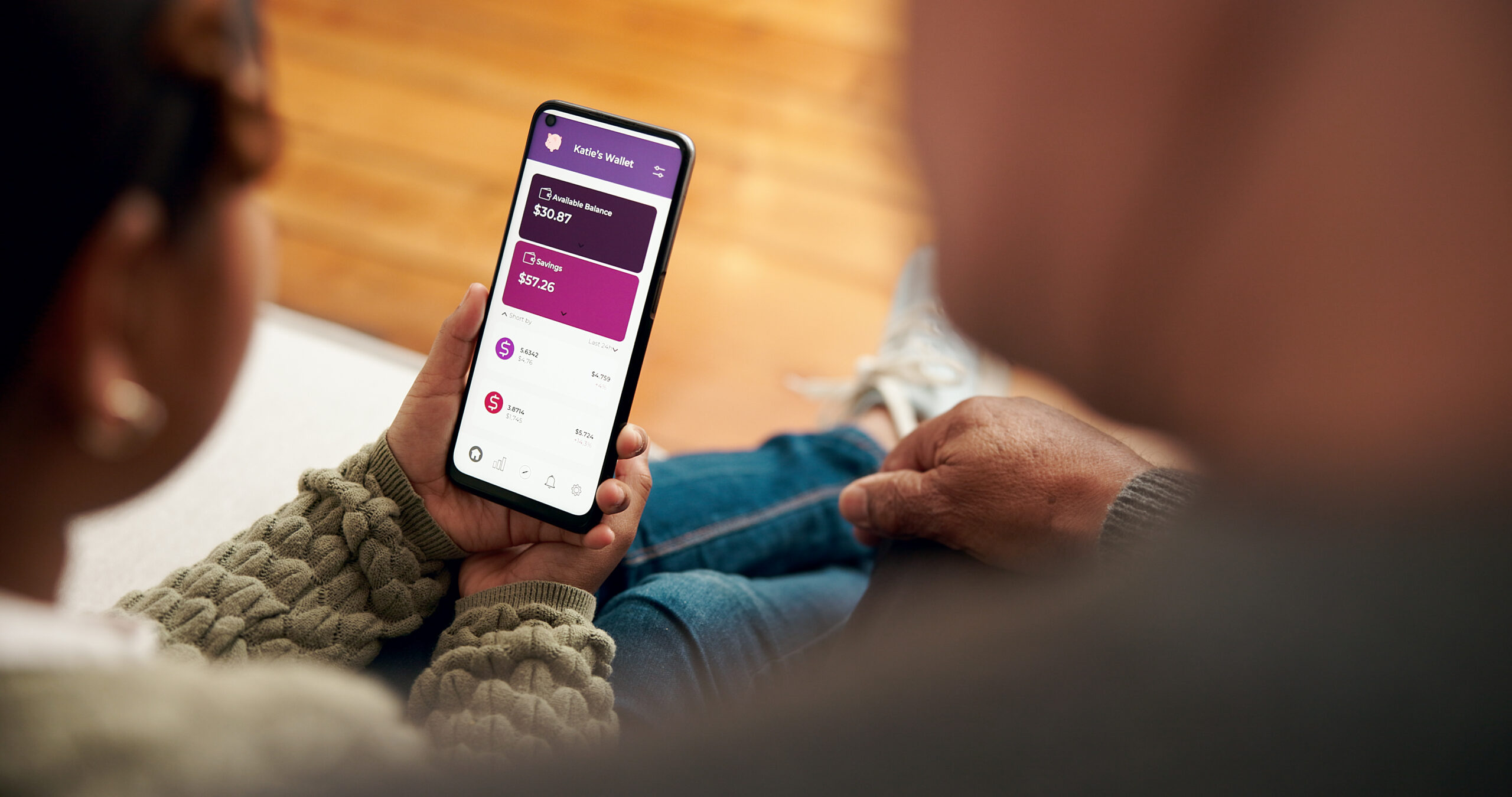

Here are some great apps that can be used to teach kids about money. Here are some examples:

- RoosterMoney: primarily an allowance app for kids, but it’s particularly handy for teaching kids about money.

- AdVenture Capitalist: a fun and easy game that extends beyond personal finance and dips your kid’s toes into the world of entrepreneurship.

- The Game of Life: a board game that teaches kids about money and life skills.

- PiggyBot: a digital piggy bank that keeps things classic and familiar for younger kids.

- Bankaroo: one of the best money apps for kids ages 5-14.

Remember, the goal isn’t to turn them into financial wizards overnight. It’s about planting seeds of knowledge that will grow as they do. By teaching our kids about finance early on, we’re setting them up for a future where they’re confident and competent with money.